ASEAN excise tax

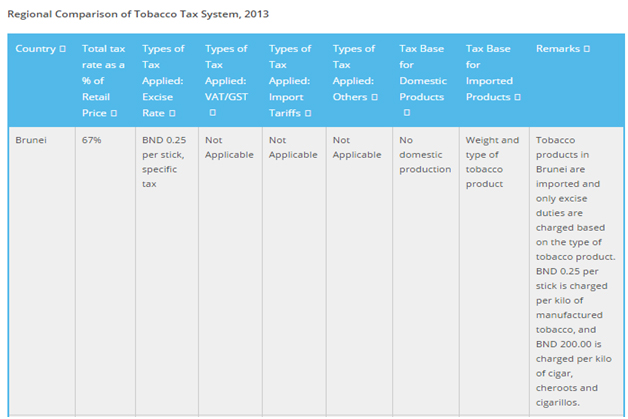

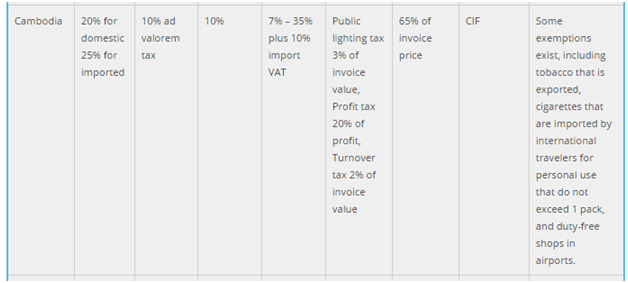

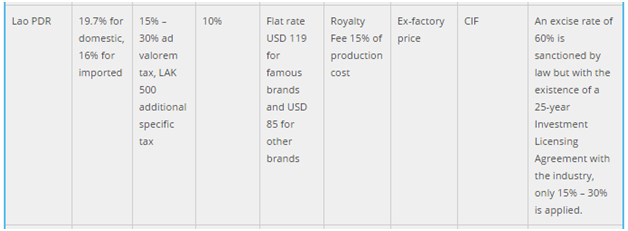

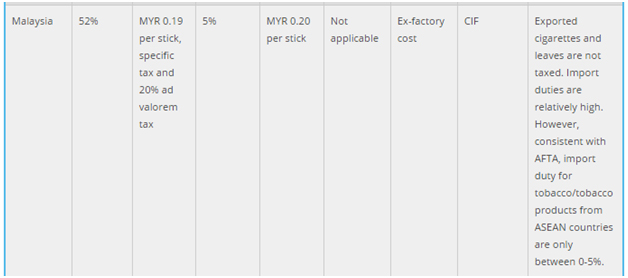

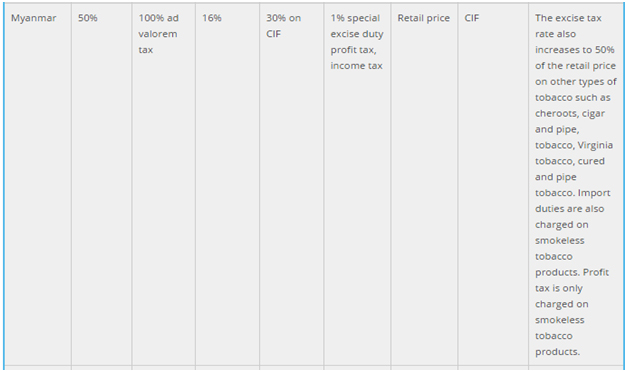

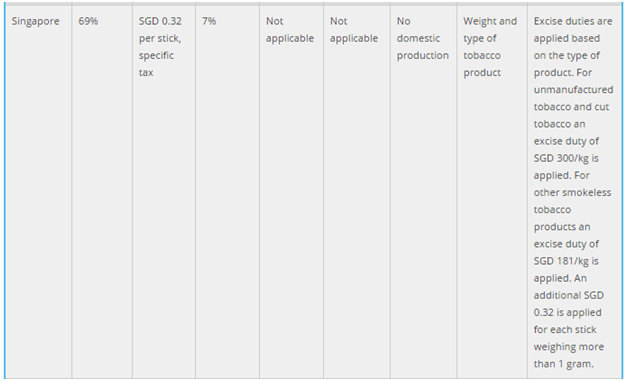

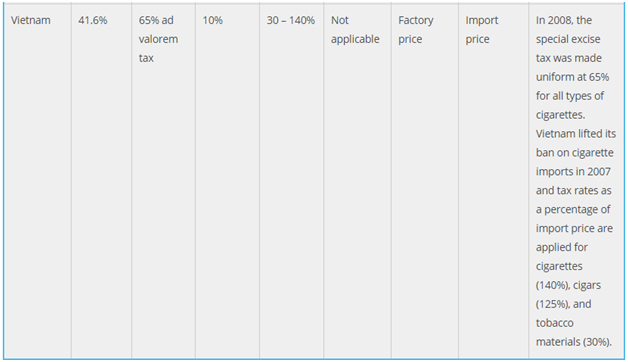

Excise tax detail devided by ASEAN countries

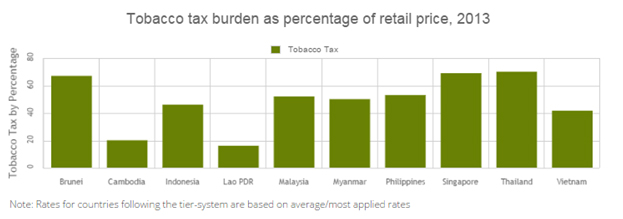

Comparison of Excise Tax in ASEAN Countries

Tobacco taxes

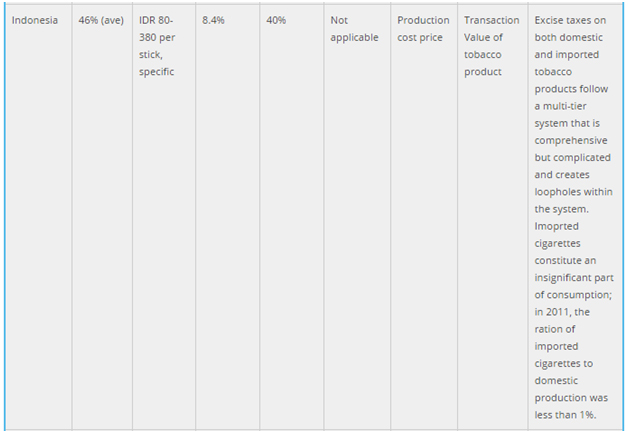

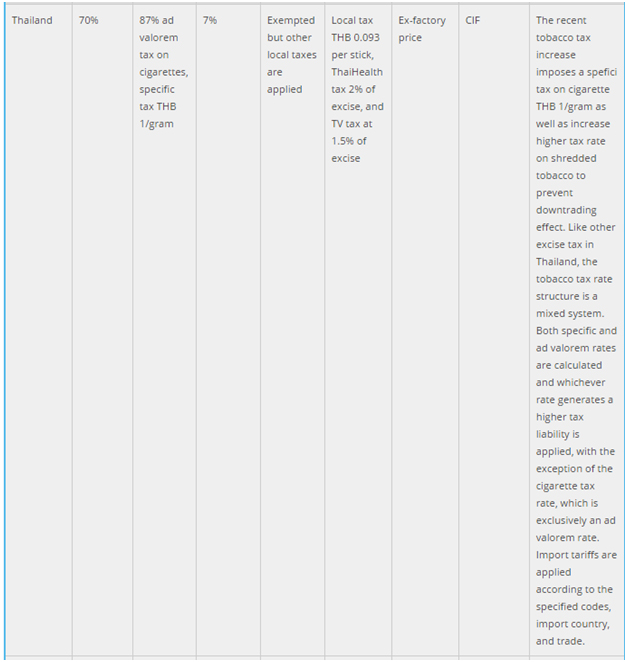

Comparison of Government Revenues from Tobacco Taxes

Government Revenue from Tobacco Tax 2005-2011 (figures in US Dollar)

| Country | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|

| Brunei | No data | No data | No data | No data | 14,139,272 | 21,627,906 | 9,612,403 |

| Cambodia | 5,100,000 | 6,200,000 | 7,800,000 | 11,100,000 | 13,100,000 | 21,627,906 | 16,443,500 |

| Indonesia | 3,548,913,043 | 4,017,391,304 | 4,726,086,957 | 5,426,086,957 | 6,017,565,217 | 6,556,188,503 | 7,591,927,284 |

| Laos PDR | 3,321,341 | 4,017,391,304 | 4,923,659 | 9,585,732 | 11,967,927 | 20,091,439 | 26,623,414 |

| Malaysia | 892,857,143 | 857,142,857 | 964,285,714 | 1,071,428,571 | 1,107,142,857 | ไม่มีข้อมูล | 1,645,569,620 |

| Philippines | 512,987,013 | 580,086,580 | 500,000,000 | 595,238,095 | 523,809,524 | 720,909,090 | 590,840,909 |

| Singapore | 510,093,057 | 444,366,500 | 501,073,729 | 568,002,863 | 666,857,552 | 683,923,076 | 749,689,922 |

| Thailand | 1,157,363,636 | 1,080,333,333 | 1,267,393,939 | 1,267,636,364 | 1,331,393,939 | 1,779,366,666 | 1,906,533,333 |

| Vietnam | 380,200,000 | 378,800,000 | 395,600,000 | 444,700,000 | 521,100,000 | 576,999,896 | 649,420,725 |

Comparison of Tobacco Tax Rates (Percentage of Retail Price)

Sources : tobaccotaxdatabase.seatca.org

Source :

Source :