ASEAN excise tax

Excise tax detail devided by ASEAN countries

Comparison of Excise Tax in ASEAN Countries

Excise tax of the Kingdom of Cambodia is referred to as “specific tax,” which describes tax that is collected from goods and services, including those that are produced within the country and those that are imported from abroad. As tax is collected from alcohol, tobacco, automobiles and oil products, excise tax collection in the Kingdom of Cambodia is undertaken in a similar manner to that of Thailand. At the same time, however, tax is collected from goods, such as tires and parts and spare parts for automobile production, which are not subject to excise tax in Thailand.

Excise Tax Collection Agencies

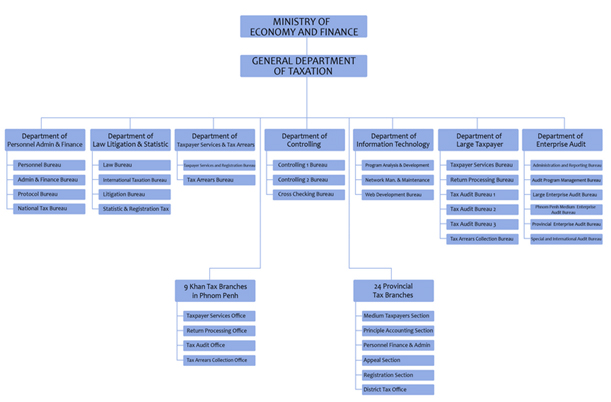

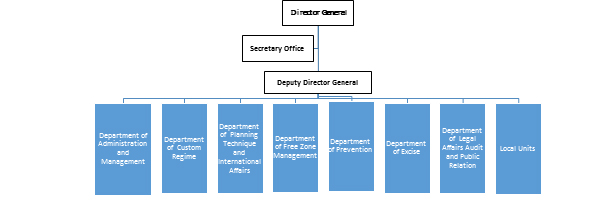

There are two state agencies that have the authority to collect excise tax in the Kingdom of Cambodia, namely the General Department of Custom and Excise of Cambodia (GDCE), who has the authority to collect tax from imported goods, and the General Department of Taxation (GDT), who has the authority to collect tax from goods and services that are produced in the country only.

Structure of General Department of Taxation

(ที่มา http://www.tax.gov.kh/files/structureen.png)

Structure of General Department of Custom and Excise of Cambodia

(ที่มา http://www.customs.gov.kh/index.php/about-gdce/organization-chart)

Taxpayers

The term “taxpayers” refers to producers and importers of goods, and service providers of specific businesses whose goods and services are subject to excise tax as stipulated by law.

Goods and Services Subject to Excise Tax

The government of the Kingdom of Cambodia undertakes the collection of excise tax from a total of 12 goods and services as listed below:

- Liquor

- Beer both domestic and import

- Wine

- Cigarette

- Cigar

- Carbonated Drink and similar (Non-Alcohol)

- Motorcycle (including motorized Tricycle) and parts that engine size over 125 cc.

- Car parts and materials that engine size less than 2,000 cc.

- Car parts and materials that engine size over 2,001 cc.

- Large vehicles such as bus and commercial trucks

- Tires, inner tube, inner tube wrapper, and other products

- Electronic devices, plastic and semi-plastic products as prescribed in announcement

- Diesel

- Lubricant, brake fluid, and materials for producing engine oil

- Air tickets both domestic and international sold in Cambodia

- Hotel business and entertainment (including spa)

- Communication services both domestic and international

Tax Base

Excise tax in Kingdom of Cambodia is collected by value of products and services. Tax of products produced in Kingdom of Cambodia is calculated from 90% of the supply value recorded in the invoice issued to a customer) except cigarette, wine, and liquor. For other services, tax base is calculated from service charge shown in invoice. For import products, tax base is calculated from CIF + Customs duty.

Tax Points

Tax points or excise tax burdens incurred by taxable persons are classified into two categories. The first category refers to the case of imported goods, where excise tax burdens are incurred along with customs duties at the time such goods are imported. On the other hand, the second category refers to the case of goods that are produced in the country, where taxable persons must submit the relevant forms and pay the relevant taxes within the 15th of the following month from the date such goods are produced.

Tax Rates

| ลำดับ | สินค้าและบริการ | อัตราภาษี (ร้อยละตามมูลค่า) |

|---|---|---|

| 1. | Liquor | 20 |

| 2. | Beer both domestic and import | 20 |

| 3. | Wine | 20 |

| 4. | Cigarette | 15 |

| 5. | Cigar | 25 |

| 6. | Carbonated Drink and similar (Non-Alcohol) | 10 |

| 7. | Motorcycle (including motorized Tricycle) and parts that engine size over 125 cc. | 10 |

| 8. | Car parts and materials that engine size less than 2,000 cc. | 20 |

| 9. | Car parts and materials that engine size over 2,001 cc. | 30 |

| 10. | Large vehicles such as bus and commercial trucks | 10 |

| 11. | Tires, inner tube, inner tube wrapper, and other products | 15 |

| 12. | Electronic devices, plastic and semi-plastic products as prescribed in announcement | 10 |

| 13. | Diesel | 4.35 |

| 14. | Lubricant, brake fluid, and materials for producing engine oil | 0-25 |

| 15. | Air tickets both domestic and international sold in Cambodia | 10 |

| 16. | Hotel business and entertainment (including spa) | 10 |

| 17. | Communication services both domestic and international | 3 |