ASEAN excise tax

Excise tax detail devided by ASEAN countries

Comparison of Excise Tax in ASEAN Countries

Excise tax collection in Thailand is collected from some goods and services in order to make consumer pay higher tax for goods and services that have negative effects to consumers’ health or morality; luxury goods; goods that have special benefits from government; goods that government has to build facilities to serve to consumers; goods that affect to environment.

Excise Tax Collection Agencies

The Excise Department, Ministry of Finance is the agency that has the authority to carry out the collection of excise tax from goods and services by virtue of several laws, namely the Excise Tax Act B.E. 2527 (1984), the Excise Tariff Act B.E. 2527 (1984), the Allocation of Liquor Tax Act B.E. 2527 (1984), the Allocation of Excise Tax Act B.E. 2527 (1984), the Liquor Act B.E. 2493 (1950), the Tobacco Act B.E. 2509 (1966) and the Playing Cards Act B.E. 2486 (1943).

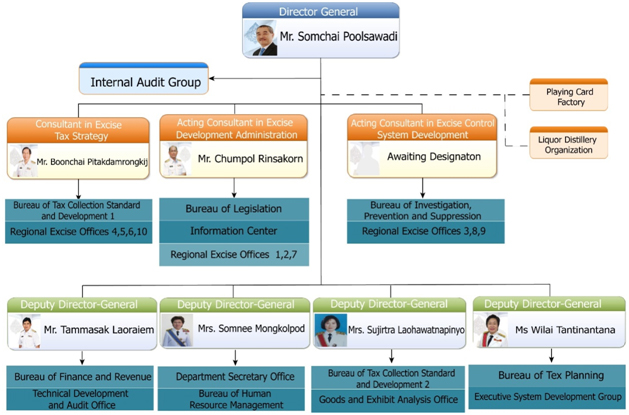

The diagram showing structure of authority within the Department.

(Source: http://excise-english.excise.go.th/ABOUT_US/ORG_CHART/index.htm)

Taxpayers

The term “taxpayers” refers to 1) producers or industrial operators 2) service operators 3) importers and 4) other persons as specified by the law, such as:

- Owner of bonded warehouse in accordance with Section 42 of the Excise Tax Act B.E. 2527 (1984)

- Industrial operator or service operator whom is newly established after a merger, or after the said industrial operator or service operator accepted the transfer of an industrial operator in accordance with Section 57 of the Excise Tax Act B.E. 2527 (1984)

- Person with privileges in accordance with Section 102 (3) of the Excise Tax Act B.E. 2527 (1984) for goods that the industrial operator is entitled to accept the return of or be exempted from tax in accordance with Section 12 paragraph 2

- Person entitled to an exemption from or reduction of tax rate for imported goods in accordance with Section 11 paragraph 2 and 3 of the Excise Tax Act B.E. 2527 (1984)

- Transferor and transferee of privileges in accordance with Section 102(3) of the Excise Tax Act B.E. 2527 that the industrial operator is entitled to accept the return of or be exempted from tax in accordance with Section 12 paragraph 2(2)

- Transferor and transferee of imported goods that is entitled to an exemption from or reduction of tax rate in accordance with Section 11 paragraph 2(2) and (3) of the Excise Tax Act B.E. 2527 (1984)

- Executor or heir who inherit imported goods entitled to an exemption from or reduction of tax rate in accordance with Section 11 paragraph 2(4) of the Excise Tax Act B.E. 2527 (1984)

- Executor, heir or inheritance possessor, curator or defender in accordance with Section 56 of the Excise Tax Act B.E. 2527 (1984)

- Liquidator and director or manager who occupied a position prior to the date that the business ceases operations in the event that the industrial operator or service operator is a juristic person and ceases operations along with liquidation in accordance with Section 58 of the Excise Tax Act

- Automobile modifier in accordance with Section 144(5) of the Excise Tax Act B.E. 2527 (1984)

- Person who committed an offence with regards to possession, sale and possession for sale in accordance with Section 161 and 162 of the Excise Tax Act B.E. 2527 (1984)

Goods and Services Subject to Excise Tax

Goods and services subject to excise tax are goods of which the state deems that consumption must be controlled as such may cause damage to human health or impact the morality of the people, non-essential goods, and goods and services that receive special benefits from state businesses as listed below:

- Oil and oil products

- Beverages

- Electrical appliances

- Crystal glass and other glass crystals

- Automobiles (passenger cars, pick-ups and buses with seats not exceeding 10 people)

- Yachts and water vehicles for the purpose of recreation

- Perfumes, perfume essences and fragrant oils

- Carpets and other textiles (made of animal fur only)

- Motorcycles

- Batteries

- Night clubs and discotheques

- Shower or steam facilities

- Horsing racing courses

- Golf courses

- Telecommunications businesses (currently tax exempt)

- Lottery (currently tax exempt)

- Liquor

- Tobacco

- Cards

Tax Base

The tax base for excise tax collection in Thailand is calculated in accordance with quantity, in accordance with value, or in accordance with quantity and value as the case may be, depending on the type and kind of the goods

- Tax Base in Accordance with Quantity. Excise tax calculation by quantity can be calculated by the formula below:

Excise Tax = Quantity of Goods × Excise Tax Rate

- Tax Base in Accordance with Value. Excisetax calculation by value can be calculated by the formula below:

- Goods Produced in the Kingdom In calculating excise tax, “value” refers to the selling price at the factory, which is inclusive of excise tax that must be paid (Excise Tax Act B.E. 2527 (1984) Section 8(1))

Excise Tax Base = Price at the Factory

- Goods Imported into the Kingdom Excise tax calculation for import goods uses tax base calculated form CIF price of goods and duty

Excise Tax Base = CIF of Goods + Taxes

- Services The base for calculating the excise tax of service places is the income of such place. For instance, the income of a horse-racing course is the entrance fees and income withheld from horse-racing gamblers. On the other hand, the income of a golf course is the membership fees and service fees of the golf course.

Excise Tax Base = Income of Service Place

- Automobile Modification In case of car modification, base for excise tax calculation is value of a car from modification, which is labor costs and parts and materials including costs to find parts and materials, but must not less than the minimum criteria as prescribed by director.

Excise Tax Base = Value from Modification (refers to the total sum of wages and costs of materials and equipment or painting costs, which must not be lower than the minimum standard as prescribed by the Director-General)

- Goods Produced in the Kingdom In calculating excise tax, “value” refers to the selling price at the factory, which is inclusive of excise tax that must be paid (Excise Tax Act B.E. 2527 (1984) Section 8(1))

Tax Points

Tax points or points in which taxpayers incur excise tax burdens in accordance with the law are classified into the following categories of goods and services:

- Goods Produced in the Kingdom Excise tax collection in domestic goods is divided toa liability of pay tax in two cases, which are goods in manufactory and goods in bonded warehouse.

- Goods in Factories

Excise tax burdens are incurred when taxpayers transport goods from the factory or bring goods for use in the factory, unless the goods are transported from the factory for the purpose of storage in a bonded warehouse (in accordance with the Law on Customs, Tax-Free Zones or Export Processing Zones). Taxpayers must submit a tax list form and pay the relevant tax prior to incurring tax liabilities. - Goods in Bonded Warehouses (in accordance with the Law on Customs, Tax-Free Zones or Export Processing Zones)

Excise tax burdens are incurred when taxpayers transport goods from the bonded warehouse, unless the goods are transported from the bonded warehouse for the purpose of returning such goods for storage in an factory or in another bonded warehouse (in accordance with the Law on Customs, Tax-Free Zones or Export Processing Zones). Taxpayers must submit a tax list form and pay the relevant tax prior to incurring tax liabilities.

In the case that VAT liabilities arise, whether wholly or partially, prior to the transportation of goods from the factory or bonded warehouse, excise tax burdens are incurred by taxpayers at the same time with VAT. Taxpayers must submit a tax list form and pay the relevant tax within the 15th of the following month from the month of incurring tax liabilities or prior to the transportation of such goods, whichever occurs first.

- Goods in Factories

- Goods Imported into the Kingdom Taxpayers incur excise tax burdens at the same time with customs duties in accordance with the Law on Customs, unless the goods are imported for the purpose of storage in a bonded warehouse (in accordance with the Law on Customs, Tax-Free Zones or Export Processing Zones). Taxpayers must incur such burdens once the goods are transported from the bonded warehouse (in accordance with the Law on Customs, Tax-Free Zones or Export Processing Zones), as the case may be. Taxpayers must submit a tax list and pay the relevant tax when the customs entry form is issued in accordance with the Law on Customs.

- Services Taxpayers incur excise tax burdens when service users have paid the service fees. In the case that VAT liabilities arise, whether wholly or partially, prior to receiving payment of the service fees, taxpayers are liable for excise tax and VAT. Taxpayers must submit a tax list and pay the relevant tax within the 15th of the following month from the month of incurring tax liabilities.

- Automobile Modification Taxpayers incur excise tax burdens once the modification is completed. Taxpayers must submit a tax list and pay the relevant tax within the 15th of the following month from the month that the modification is completed.

- Automobiles Brought for Display or Kept in Automobile Showrooms for Sale Taxpayers incur excise tax burdens at the same time with VAT. Taxpayers must submit a tax list and pay the relevant tax within the 15th of the following month from the month of incurring tax liabilities.

Tax Rates

To specify tax rate of goods and services, related laws and regulations prescribe maximum tax rate for excise tax calculation divided by types and characteristics of products and services. However, while shall come into force as law on tax rate of goods and services, currently, it is amended in order to suite with economics, social, and politics under the law.

| Type No. |

Item |

Tax Rate |

||||||

|---|---|---|---|---|---|---|---|---|

Tax Rate Ceiling by Law |

Current Tax Rate |

|||||||

Ad Valorem |

Per Unit |

Ad Valorem |

Per Unit |

|||||

Unit |

Baht per Unit |

Unit |

Baht per Unit |

|||||

Part 1 |

Oil and Oil Products |

42 |

Liters (remainder of a liter is counted as one liter) |

10 |

0 |

Liters (remainder of a liter is counted as one liter) |

7.000 |

|

| (2) Benzene other than (1) | 42 |

Liters (remainder of a liter is counted as one liter) |

10 |

0 |

Liters (remainder of a liter is counted as one liter) |

7.000 |

||

| (3) Imported lead-free benzene for sale to privileged persons in accordance with Thailand’s obligations to the United Nations, in accordance with international law, or in accordance with international agreements or diplomatic customs (in accordance with the terms and conditions announced by the Minister) | 42 |

Liters (remainder of a liter is counted as one liter) |

10 |

Tax Exempt |

||||

| (4) Gasohol E10 (in accordance with the terms and conditions announced by the Minister) | 42 |

Liters (remainder of a liter is counted as one liter) |

10 |

0 |

Liters/Remainder of a Liter |

6.300 |

||

| (5) Gasohol E20 (in accordance with the terms and conditions announced by the Minister) | 42 |

Liters (remainder of a liter is counted as one liter) |

10 |

0 |

Liters (remainder of a liter is counted as one liter) |

5.600 |

||

| (6) Gasohol E85 (in accordance with the terms and conditions announced by the Minister) | 42 |

Liters (remainder of a liter is counted as one liter) |

10 |

0 |

Liters (remainder of a liter is counted as one liter) |

1.050 |

||

01.02 |

-Naphtha, reformate, pyrolysis gasoline and similar liquids (1) Naphtha, reformate, pyrolysis gasoline and similar liquids |

42 |

Liters (remainder of a liter is counted as one liter) |

10 |

36 |

Liters (remainder of a liter is counted as one liter) |

7.000 |

|

01.03 |

- Kerosene and other combustible fuels | |||||||

| (1) Kerosene and other combustible fuels | 34 |

Liters (remainder of a liter is counted as one liter) |

4 |

0 |

Liters (remainder of a liter is counted as one liter) |

3.055 |

||

01.04 |

- Fuel oils for jets (1) Fuel oils for jets that do not use fuels for air vehicles |

34 |

Liters (remainder of a liter is counted as one liter) |

4 |

23 |

Liters (remainder of a liter is counted as one liter) |

3.000 |

|

| (2) Fuel oils for jets used as fuel oils for air vehicles in the country in accordance with the rules, procedures and conditions stipulated by the Director-General | 34 |

Liters (remainder of a liter is counted as one liter) |

4 |

1 |

Liters (remainder of a liter is counted as one liter) |

0.200 |

||

| (3) Fuel oils for jets used as fuel oils for air vehicles bound for foreign countries in accordance with the rules, procedures and conditions stipulated by the Director-General | 34 |

Liters (remainder of a liter is counted as one liter) |

4 |

Tax Exempt |

||||

01.05 |

- Diesel fuel and other similar fuels (1) Diesel fuel with sulfur exceeding 0.035% (weight) |

34 |

Liters (remainder of a liter is counted as one liter) |

10 |

0 |

Liters (remainder of a liter is counted as one liter) |

5.310 |

|

| (2) Diesel fuel with sulfur not exceeding 0.035% (weight) | 34 |

Liters (remainder of a liter is counted as one liter) |

10 |

0 |

Liters (remainder of a liter is counted as one liter) |

0.0050 |

||

| (3) Diesel fuel sold in connecting territory with the Kingdom in accordance with the terms and conditions stipulated by the Minister | 34 |

Liters (remainder of a liter is counted as one liter) |

10 |

Tax Exempt |

||||

| (4) Diesel fuel filled in connecting territory with the Kingdom in registered vessels for fishing purposes in accordance with the Thai Vessels Act B.E. 2481 (1938) and remaining in the tank of such vessel upon travel into the Kingdom | 34 |

Liters (remainder of a liter is counted as one liter) |

10 |

Tax Exempt |

||||

| (5) Diesel fuel with methyl ester biodiesel mixed with no less than 4% of fatty acids in accordance with the terms and conditions stipulated by the Minister | 34 |

Liters (remainder of a liter is counted as one liter) |

10 |

0 |

Liters (remainder of a liter is counted as one liter) |

0.0050 |

||

01.06 |

- Natural gas liquids (NGL) and similar gas liquids |

42 |

Liters (remainder of a liter is counted as one liter) |

10 |

36 |

Liters (remainder of a liter is counted as one liter) |

5.310 |

|

| (2) Natural gas liquids (NGL) and similar gas liquids brought into the distillation process in oil refineries | 42 |

Liters (remainder of a liter is counted as one liter) |

10 |

Tax Exempt |

||||

01.07 |

- Liquefied petroleum gas (LPG), liquid propane and similar gases (1) Liquefied petroleum gas (LPG) and similar gases |

34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

9 |

0 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

2.170 |

|

| (2) Liquid propane and similar gases | 34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

9 |

23 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

2.170 |

||

| (3) Liquefied petroleum gas (LPG), propane and similar gases used in the production of electricity and sold to the Electricity Generating Authority of Thailand in accordance with the rules, procedures and conditions stipulated by the Director-General | 34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

9 |

Tax Exempt |

||||

01.08 |

- Liquid methane, liquid ethane, liquid butane, butane isomers in liquid or gas state or similar liquids (1) Liquid methane, liquid ethane, butane isomers in liquid or gas state or similar liquids |

34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

13 |

Tax Exempt |

|||

| (2) Liquid ethane | 34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

13 |

23 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

2.170 |

||

01.09 |

- Liquid ethylene, liquid propylene, liquid butylene and similar liquids (1) Liquid ethylene, liquid propylene, liquid butylene and similar liquids |

34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

9 |

23 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

2.170 |

|

| (2) Liquid ethylene and similar liquids exceeding 95% purity | 34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

9 |

Tax Exempt |

||||

| (3) Liquid propylene, liquid butylene, butane isomers in liquid or gas state, liquid butadiene and similar liquids exceeding 90% purity | 34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

9 |

Tax Exempt |

||||

01.10 |

Methane gas, ethane gas, propane gas, butane gas, butane isomers in gas state and similar gases (1) Ethane gas |

34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

13 |

23 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

2.170 |

|

| (2) Propane gas | 34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

13 |

23 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

2.170 |

||

| (3) Methane gas, butane gas, butane isomers in gas state and similar gases | 34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

13 |

Tax Exempt |

||||

01.11 |

- Ethylene, propylene, butylene, butylene isomers, butadiene in gas state and similar gases (1) Ethylene, propylene, butylene, butylene isomers, butadiene in gas state and similar gases |

34 |

Kilograms (remainder of a kilogram is counted as one kilogram) |

9 |

Tax Exempt |

|||

| (3.1) Hydrocarbon solvents with the qualifications announced by the Minister | 42 |

- |

- |

30 |

- |

- |

||

| (3.2) Hydrocarbon solvents with the qualifications announced by the Minister for use in various industries in accordance with the terms and conditions announced by the Minister | 42 |

- |

10 |

Tax Exempt |

||||

01.11 and |

(1) Oil and oil products that can be produced by industrial operators and brought into the production process in factories in accordance with the rules, procedures and conditions stipulated by the Director-General | - |

- |

- |

Tax Exempt |

|||

| (2) Oil and oil products brought as raw materials or components for the production of oil and oil products in factories in accordance with the rules, procedures and conditions stipulated by the Director-General | - |

- |

- |

Tax Exempt |

||||

Part 2 |

Beverages |

25 |

Baht/440 cc |

0.770 |

25 |

Baht/440 cc |

0.770 |

02.02 |

Mineral water and carbonated water with sugar or sweetening additives and flavoring agents, and other non-alcoholic beverages (exclusive of fruit and vegetable juices in 2.03) |

20 |

Baht/440 cc |

0.450 |

20 |

Baht/440 cc |

0.370 |

02.03 |

Non-fermented and non-alcohol fruit and vegetable juices with and without sugar or sweetening additives - Ingredients as stipulated by the Department (not yet stipulated) |

|

|

|

|

|

|

Part 3 |

Electrical Appliances |

|

|

|

|

|

|

| (2) Others other than (1) | - |

- |

- |

15 |

Tax Exempt |

||

03.02 |

Lamps and chandeliers |

15 |

- |

- |

Tax Exempt |

||

Chandeliers made from crystal glass and other glass crystals or a mixture thereof |

15 |

- |

- |

15 |

- |

- |

|

Part 4 |

Glass and Glassware |

|

|

|

|

|

|

| (2) Beads, artificial pearls, artificial gemstones or partially artificial gemstones and similar small-sized glasses | 30 |

- |

- |

15 |

- |

- |

|

| (3) Goods in (1) or (2) used as raw materials or components in the production of goods or other things in accordance with the rules stipulated by the Director-General | 30 |

- |

- |

15 |

- |

- |

|

Part 5 |

Automobiles (3) Passenger cars(1.1) With an engine displacement not exceeding 2,000 cc and engine power not exceeding 220 hp |

50 |

- |

- |

30 |

- |

- |

| (1.2) With an engine displacement exceeding 2,000 cc but not 2,500 cc and engine power not exceeding 220 hp | 50 |

- |

- |

35 |

- |

- |

|

| (1.3) With an engine displacement exceeding 2,500 cc but not 3,000 cc and engine power not exceeding 220 hp | 50 |

- |

- |

40 |

- |

- |

|

| (1.4) With an engine displacement exceeding 3,000 cc or engine power exceeding 220 hp | 50 |

- |

- |

50 |

- |

- |

|

| (4) Pick-up passenger vehicles (PPV) with the qualifications stipulated by the Minister of Finance (2.3) With an engine displacement not exceeding 3,250 cc |

50 |

- |

- |

20 |

- |

- |

|

| (2.4) With an engine displacement exceeding 3,250 cc | 50 |

- |

- |

50 |

- |

- |

|

| (4) Double cabs with the qualifications announced by the Minister of Finance (3.3) With an engine displacement not exceeding 3,250 cc |

50 |

- |

- |

12 |

- |

- |

|

| (3.4) With an engine displacement exceeding 3,250 cc | 50 |

- |

- |

50 |

- |

- |

|

| (8) Passenger cars with the qualifications announced by the Minister of Finance and produced from pick-ups or chassis with windshields of pick-ups, or modified from pick-ups (4.2) Produced or modified by industrial operators with the qualifications announced by the Minister of Finance

|

50 |

- |

- |

3 |

- |

- |

|

|

50 |

- |

- |

50 |

- |

- |

|

| (4.3) Modified by modifiers in accordance with Section 144(3) (taxable under Section 144(3) and Section 144(5)) | 50 |

- |

- |

Tax Rate in (1) |

- |

- |

|

05.02 |

Passenger cars with a capacity fewer than 10 people (5) With an engine displacement not exceeding 2,000 cc and engine power not exceeding 220 hp |

50 |

- |

- |

30 |

- |

- |

| (6) With an engine displacement exceeding 2,000 cc but not 2,500 cc and engine power not exceeding 220 hp | 50 |

- |

- |

35 |

- |

- |

|

| (7) With an engine displacement exceeding 2,500 cc but not 3,000 cc and engine power not exceeding 220 hp | 50 |

- |

- |

40 |

- |

- |

|

| (8) With an engine displacement exceeding 3,000 cc or engine power exceeding 220 hp | 50 |

- |

- |

50 |

- |

- |

|

05.01 and 05.02 |

Passenger cars with a capacity fewer than 10 people (5) Passenger cars or vehicles with a capacity fewer than 10 people and used as ambulances of the state, hospitals or public charities in accordance with the terms, conditions and amount announced by the Minister of Finance |

50 |

- |

- |

Tax Exempt |

- |

- |

| (6) Energy-efficient passenger cars or vehicles with a capacity fewer than 10 people (2.5) Hybrid electric vehicles

|

50 |

- |

- |

10 |

- |

- |

|

|

50 |

- |

- |

50 |

- |

- |

|

| (2.6) Electric powered vehicles | 50 |

- |

- |

10 |

- |

- |

|

| (2.7) Fuel cell powered vehicles | 50 |

- |

- |

10 |

- |

- |

|

| (2.8) Modern energy-efficient cars | 50 |

- |

- |

- |

- |

||

|

50 |

- |

- |

17 |

- |

- |

|

|

50 |

- |

- |

- |

- |

- |

|

(7) Alternative fuel passenger cars or vehicles with a capacity fewer than 10 with an engine displacement not exceeding 3,000 cm3

(3.4) Not less than 20% of fuel is mixed with ethanol

|

50 |

- |

- |

25 |

- |

- |

|

|

50 |

- |

- |

30 |

- |

- |

|

|

50 |

- |

- |

35 |

- |

- |

|

|

50 |

- |

- |

50 |

- |

- |

|

| (3.5) Natural gas as fuel | 50 |

- |

- |

20 |

- |

- |

|

(3.6) Not less than 85% of fuel is mixed with ethanol

|

50 |

- |

- |

22 |

- |

- |

|

|

50 |

- |

- |

27 |

- |

- |

|

|

50 |

- |

- |

32 |

- |

- |

|

| (8) Three-wheeled passenger cars and passenger cars produced from motorcycle engines with a size not exceeding 250 cc (4.3) Three-wheeled passenger cars |

50 |

- |

- |

5 |

- |

- |

|

| (4.4) Passenger cars produced from motorcycle engines with a size not exceeding 250 cc | 50 |

- |

- |

5 |

- |

- |

|

05.90 |

(1) Pickup cars designed to have a total weight not exceeding 4,000 kilograms

(1.1) Pickup cars designed to have a total weight not exceeding 4,000 kilograms (1.1.1) With an engine displacement not exceeding 3,250 cc (1.1.1.1) With the qualifications announced by the Minister of Finance |

50 |

- |

- |

3 |

- |

- |

| (1.1.1.2) With qualifications other than in (1.1.1.1) | 50 |

- |

- |

18 |

- |

- |

|

| (1.2) With an engine displacement exceeding 3,250 cc | 50 |

- |

- |

50 |

- |

- |

Part 6 |

Boats |

50 |

- |

- |

Tax Exempt |

- |

- |

| (2) Row-boats, scull boats and inflatable boats | 50 |

- |

- |

Tax Exempt |

- |

- |

|

| (3) Boats used for sport activities in accordance with the rules, procedures and conditions stipulated by the Director-General | 50 |

- |

- |

Tax Exempt |

- |

- |

|

Part 7 |

Perfume and Cosmetic Products (1) Perfumes, perfume essences and fragrant oils Perfumes and perfume essences (exclusive of perfumes and perfume essences in (3)) |

20 |

- |

- |

15 |

- |

- |

| (2) Fragrant oils | 20 |

- |

- |

Tax Exempt |

- |

- |

|

| (3) Perfumes and perfume essences that are local products produced in Thailand | 20 |

- |

- |

Tax Exempt |

- |

- |

|

Part 8 |

Other Goods |

30 |

- |

- |

20 |

- |

- |

Two-stroke motorcycles |

30 |

- |

- |

5 |

- |

- |

|

Four-stroke motorcycles |

30 |

- |

- |

3 |

- |

- |

|

Marble and granite |

30 |

- |

- |

Tax Exempt |

- |

- |

|

Batteries |

30 |

- |

- |

10 |

- |

- |

|

| Batteries made from taxable raw materials | 30 |

- |

- |

5 |

- |

- |

|

Ozone depleting substances |

30 |

- |

- |

30 |

- |

- |

|

Part 9 |

Entertainment or Recreation Businesses |

20 |

- |

- |

10 |

- |

- |

| (2) Other sources of income | 20 |

- |

- |

Tax Exempt |

- |

- |

|

09.02 |

Shower or Steam and Massage Facilities (1) Income from shower or steam and massage services from service users |

20 |

- |

- |

10 |

- |

- |

| - Income from shower or steam and massage services in schools, temples, places for religious ceremonies, hospitals, clinics, and salons for health purposes in accordance with the rules stipulated by the Director-General | 20 |

- |

- |

Tax Exempt |

- |

- |

|

| (2) Other sources of income | 20 |

- |

- |

Tax Exempt |

- |

- |

Part 10 |

Gambling Businesses - Entrance Fees |

20 |

- |

- |

20 |

- |

- |

- Income withheld from horse-racing gamblers and deducted from the prize money paid to horse-racing gamblers |

20 |

- |

- |

20 |

- |

- |

|

- Other sources of income |

20 |

- |

- |

Tax Exempt |

- |

- |

|

10.02 |

Income from Lottery |

20 |

- |

- |

Tax Exempt |

- |

- |

Part 11 |

Businesses that Impact the Environment - Membership Fees |

20 |

- |

- |

10 |

- |

- |

- Service Fees |

20 |

- |

- |

10 |

- |

- |

|

- Others |

20 |

- |

- |

Tax Exempt |

- |

- |

|

Part 12 |

Permitted or Concession Businesses - Basic Telecommunications Businesses |

50 |

- |

- |

0 |

- |

- |

- Mobile Phone or Cellular Radio Businesses |

50 |

- |

- |

Tax Exempt |

- |

- |

|

- Others |

50 |

- |

- |

Tax Exempt |

- |

- |

(Source : Information is organized by the Division of Income Tax and Consumption Policies, Bureau of Tax Policies, Excise Department)

Tax Benefits

Government prescribes that excise tax payers must pay excise tax for goods and services. However, in some cases, government may give tax benefit by exempt or reduce tax for some goods and services.

- Industrial operators are entitled to request a tax exemption or tax return in accordance with the Law on Excise Tax

- Persons who purchase or receive goods produced in the Kingdom from industrial operators for the purpose of exporting out of the Kingdom or importing into tax-free zones, who are authorized by such industrial operator, are entitled to request a tax exemption or tax return

- Juristic persons (who are not industrial operators) that initially purchase or receive goods produced in the Kingdom from industrial operators for the purpose of exporting out of the Kingdom or importing into tax-free zones, who are not authorized by such industrial operator, are entitled to request a tax return

- Other persons that did not initially purchase or receive goods produced in the Kingdom from industrial operators are entitled to request a tax return

- Industrial operators in accordance with the Law on Excise Tax B.E. 2527 (1984) and

- Persons who purchase or receive goods produced in the Kingdom from industrial operators for the purpose of exporting out of the Kingdom or importing into tax-free zones, who are authorized by such industrial operator

- Oil and oil products

- Automobiles

- Air-conditioners

- Motorcycles

- Batteries

- Beverages

(1) Tax Exemption or Tax Return for Goods Exported out of the Kingdom or Imported into Tax-Free Zones. Persons entitled to request a tax exemption or tax return for goods exported out of the Kingdom or imported into tax-free zones are listed below:

(2) Tax Exemption for Goods Exported out of the Kingdom or Imported into Tax-Free Zones to be Stored in Warehouses. Persons entitled to request a tax exemption for goods exported out of the Kingdom or imported into tax-free zones to be stored in warehouses are listed below:

(3) Excise Tax Reduction. Industrial operators can submit a statement of intent to request a tax reduction along with related documents at the Excise Office in the area of which their factory is located. The statement of intent to request a tax reduction must be submitted with Form PorSor.01-29 and Form PorSor.01-30 along with details of the capital structure, production formulas, tax invoices, the account of goods brought for use as raw materials in the production and the notification form for the selling price. Goods that industrial operators can request for a tax reduction in accordance with Section 11 of the Excise Tax Act B.E. 2527 (1984) and related ministerial rules are listed below:

Tax Sanctions

When excise tax payers are specified, they must pay tax. If ones violate the law, there are force measures by tax as follows:

-

(1) Fines. Taxpayers shall subject to a fine in the cases and at the rates as listed below:

- In the case that the tax list is not submitted within the stipulated period, whether excise tax registration is made or not, taxpayers shall be subject to a fine of twice the tax amount

- In the case that the tax list is submitted in an incorrect manner, causing a reduction of the tax amount that must be paid, taxpayers shall be subject to a fine of twice the missing tax amount

- Industrial operators or service operators who do not submit an excise tax registration or a notification of moving or closing down the factory or service place within the stipulated period shall be subject to a fine not exceeding Baht 5,000

- Industrial operators or service operators who do not openly disclose their excise tax registration certificate, or have torn or lost their tax registration certificate and did not ask for a replacement within 30 days from the date of being informed, and within 15 days in the case of their bonded warehouse license being torn or lost, shall be subject to a fine not exceeding 4,000 Baht

- Any persons who do not notify the selling price at the factory or the service fee within the stipulated period shall be subject to a fine not exceeding Baht 5,000

- Taxpayers who do not submit a tax list within the period stipulated by law shall be subject to a fine of twice the tax amount. In the case that a tax list is submitted in an incorrect manner, causing a reduction of the tax amount that must be paid, taxpayers shall be subject to a fine of twice the missing tax amount

- Taxpayers who do not pay the tax within the period stipulated by law shall be subject to a surcharge of 1.5% of the tax amount that must be paid (exclusive of fines) per month. The calculation of surcharges must not be compounded or exceed the tax amount that must be paid (exclusive of fines)

- Any persons who give false statements or false answers, or bring false evidence, or submit false accounts or documents to avoid the payment of tax shall be subject to a period of imprisonment not exceeding 7 years and a fine not exceeding 300,000 Baht

(2) Surcharges. Taxpayers who do not pay the tax within the stipulated period or partially paid the tax amount that must be paid shall be subject to a surcharge of 1.5% of the tax amount that must be paid (exclusive of fines) per month. The calculation of surcharges must not be compounded or exceed the tax amount that must be paid (exclusive of fines).

(3) Penalties