ASEAN excise tax

Excise tax detail devided by ASEAN countries

Comparison of Excise Tax in ASEAN Countries

Vietnam became a member of ASEAN in B.E. 2538 (1995) in order to become a part of the ASEAN Free Trade Zone. It later become part of a global economic bloc upon becoming a WTO member in B.E. As of now, Vietnam has the most open economic system in Asia with the value of international trade amounting to almost two times more than the total amount of products in Vietnam. Vietnam has planned to become ready for the commencement of the ASEAN Economic Community through its tax administration modernization project.

Excise tax that is collected in Vietnam is in the form of special sales tax (SST), which is collected from imported goods and certain types of services, including oil, cigarettes, motor vehicles, air conditioners, alcohol, playing cards, beers, golf, discotheque, karaoke or casino businesses.

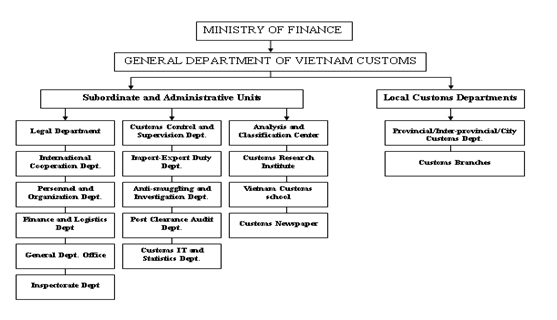

Excise Tax Collection Agencies

The state agency that has the authority to collect excise tax in Vietnam is the Customs Department, which falls under the jurisdiction of the Ministry of Finance.

(Source: http://www.customs.gov.vn)

Goods Subject to Excise Tax

- Tobacco

- Liquors

- Beers

- Motor vehicles with a capacity of fewer than 24 people

- Motorbikes with an engine displacement exceeding 125 cc

- Airplanes and yachts

- All types of oil

- Playing cards

- Air conditioners with a capacity not exceeding 90,000 BTU

- Votive gilt papers and votive objects

- Dance studios

- Massage and karaoke facilities

- Casinos

- Gambling dens

- Golf courses

- State lottery

Tax Base

The tax base used in the calculation of excise tax in Vietnam can be classified into two categories, namely goods produced in the country and imported goods:

- Goods Produced in the Country

- Goods Imported from Abroad

Excise Tax = [Selling Price (exclusive of VAT) – Environmental Taxes (if any)] x Excise Tax Rate

1 + Excise Tax Rate

Excise Tax = (Price used for the Calculation of Import Duties + Import Duties) x Excise Tax Rate

(Source: www.dncustoms.gov.vn)

Tax Rates

| Goods and Services | Tax Rate (%) |

|---|---|

| 1. Cigarettes | 65 |

| 2. Alcoholic beverages with at least 20 degrees | 50 |

| 3. Alcoholic beverages with less than 20 degrees | 25 |

| 4. Beers | 50 |

| 5. Motor vehicles with a capacity fewer than 24 people | 50 |

| 6. Motorbikes with an engine displacement exceeding 125 cc | 20 |

| 7. Airplanes | 30 |

| 8. Yachts | 30 |

| 9. Oil | 10 |

| 10. Air conditioners with a capacity not exceeding 90,000 BTU | 10 |

| 11. Playing cards | 40 |

| 12. Votive gilt papers and votive objects | 70 |

| 13. Dance studios | 40 |

| 14. Massage and karaoke facilities | 30 |

| 15. Casinos | 30 |

| 16. Gambling dens | 30 |

| 17. Golf courses | 20 |

| 18. State lottery | 15 |