ASEAN excise tax

Excise tax detail devided by ASEAN countries

Comparison of Excise Tax in ASEAN Countries

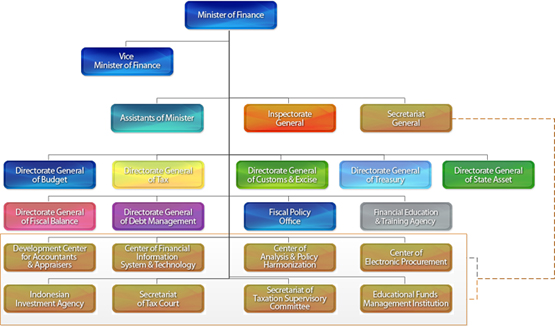

Excise Tax Collection Agencies

The agency that has the authority to carry out the collection of excise tax in the Republic of Indonesia is the Directorate General of Customs and Excise, which is under the jurisdiction of the Ministry of Finance. The Directorate General of Customs and Excise is responsible for stipulating customs and excise tax policies, carrying out such policies, and issuing laws, principles, procedures and regulations related to customs and excise tax as well as giving advice and evaluating the results of the aforementioned matters.

Structure of Directerate Genenal of Customs and Excise

(Source : http://www.kemenkeu.go.id/en/Page/orgchart)

Taxpayers

The term “taxpayers” refer to importers and producers of goods.

Goods Subject to Excise Tax

The government of Indonesia carries out the collection of excise tax from the goods as follows: goods of which the government deems that consumption must be controlled or production and transportation must be controlled, goods that present a harm to society and the environment and goods of which consumption must be limited by age. Goods subject to excise tax can be classified into 3 categories, namely alcohol products, tobacco and non-essential goods.

1) Alcohol Products can be classified into alcoholic beverages, beverages mixed with alcohol and alcohol essences

2) Tobacco can be classified into two categories, namely machine-made tobacco and hand-rolled tobacco

3) Non-essential Goods

- Household appliances, coolers, heaters, and television broadcasting receivers, aerials, aerial reflectors

- Sport equipment, articles and accessories

- Air conditioners, dish washing machines, driers, and electromagnetic devices

- Video recording or reproduction devices

- Photographic and cinematographic devices and related accessories

- Luxury residences such as luxury houses, apartments, condominiums, town houses and the like

- Perfumes

- Ships or other water vehicles, row boats and canoes, except for state or public transportation needs

- Musical instruments

- Articles made of leather or artificial leather

- Carpets made from silk or wool

- Glassware of lead crystal of the type used for tables, kitchens, makeup, officers or indoor decoration for similar purposes

- Articles partially or wholly made of precious metal or metal coated with precious metal or a mixture thereof, and/or pearl or a mixture thereof

- Balloons, dirigibles, and other un-powered aircraft

- Shotguns and other arm cartridges, firearms and other arms, except for the state purposes

- Footwear

- Home and office furniture and fixtures

- Articles made of porcelain, china clay or ceramic

- Articles partly or wholly made of stones, other than curb stone

- Carpets made from fine animal hair

- Aircraft other than those for the state or commercial air-transport purposes

- Luxury cruisers, except for the need of the state and public transport

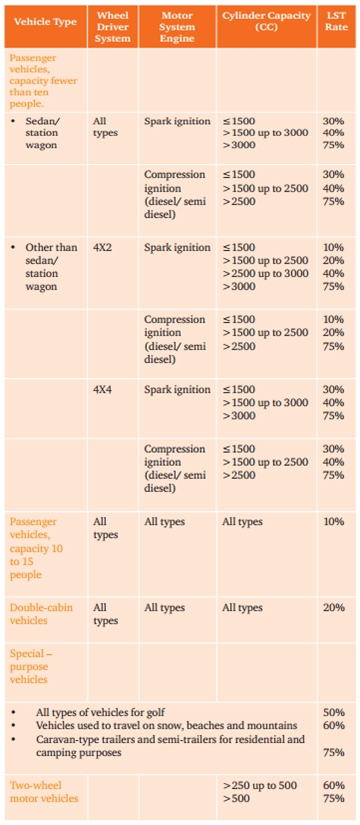

4) Vehicles/Automobiles

- Passenger vehicles, capacity fewer than ten people

- Sedan/station wagon

- Other than sedan/station wagon (classified by engine system and capacity)

- Passenger vehicles, capacity 10-15 people

- Double-cabin vehicles

- Special-purpose vehicles (all types of vehicles for golf, vehicles used to travel on snow, beaches and mountains, caravan-type trailers and semi-trailers for residential and camping purposes)

Two-wheel motor vehicles

Tax Base

The tax base for excise tax collection is calculated per unit, ad valorem, or per unit and ad valorem, depending on the type of the goods. In the case of alcoholic beverages, the tax rate is per unit. On the other hand, in the case of tobacco, the tax rate is per unit and ad valorem. In the case of non-essential goods and automobiles, the tax rate is ad valorem.

Tax Points

In the case of non-essential goods, the government will carry out the collection of excise tax on a monthly basis along with VAT.

Tax Rate

- Tax Rate of Non-essential Goods

Source : Indonesian Pocket Tax Book,PWC,2015Category of Goods Tax Rate (LST) 10 20 30 40 50 75 Household appliances, coolers, heaters, and television broadcasting receivers, aerials, aerial reflectors • • Sport equipment, articles and accessories • • • Air conditioners, dish washing machines, driers, and electromagnetic devices • • Video recording or reproduction devices • Photographic and cinematographic devices and related accessories • Luxury residences such as luxury houses, apartments, condominiums, town houses and the like • Perfumes • Ships or other water vehicles, row boats and canoes, except for state or public transportation needs • • Musical instruments • Articles made of leather or artificial leather • Carpets made from silk or wool • Glassware of lead crystal of the type used for tables, kitchens, makeup, officers or indoor decoration for similar purposes • Articles partially or wholly made of precious metal or metal coated with precious metal or a mixture thereof, and/or pearl or a mixture thereof • • Balloons, dirigibles, and other un-powered aircraft • Shotguns and other arm cartridges, firearms and other arms, except for the state purposes • • Footwear • Home and office furniture and fixtures • Articles made of porcelain, china clay or ceramic • Articles partly or wholly made of stones, other than curb stone • Carpets made from fine animal hair • Aircraft other than those for the state or commercial air-transport purposes • Luxury cruisers, except for the need of the state and public transport •

- Tax Rate of Automobiles

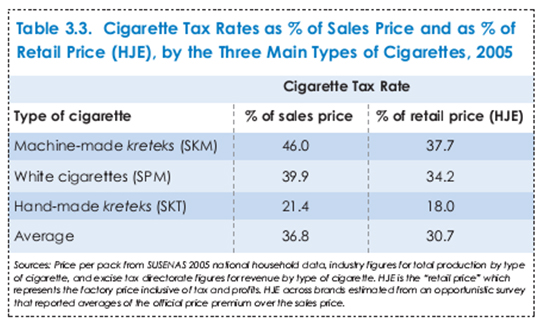

Source : Indonesian Pocket Tax Book,PWC,2015 - Tax Rate of Tobacco

Source : Sarah Barber, Sri Moertiningsih Adioetomo, Abdillah Ahsan, Diahhadi Setyonaluri,Tobacco economics in Indonesia, Paris: International Union Against Tuberculosis and Lung Disease; 2008.

Source : Sarah Barber, Sri Moertiningsih Adioetomo, Abdillah Ahsan, Diahhadi Setyonaluri,Tobacco economics in Indonesia, Paris: International Union Against Tuberculosis and Lung Disease; 2008.

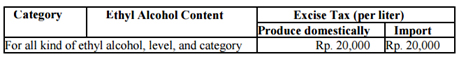

- Tax Rate of Alcoholic Beverages

- Ethyl Alcohol or Ethanol

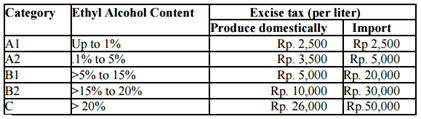

- Beverages Containing Ethyl Alcohol

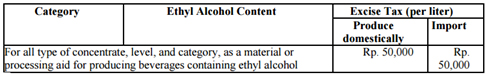

- Concentrate Contain Ethyl Alcohol

- Ethyl Alcohol or Ethanol