ASEAN excise tax

Excise tax detail devided by ASEAN countries

Comparison of Excise Tax in ASEAN Countries

Vehicle taxes

Comparison of Vehicle Taxes

| Country | <2000cc | 2-3000cc | >3000cc | 10-16 seat | >16 seat | Pick-up |

|---|---|---|---|---|---|---|

| Brunei | 20% | 20% | 20% | 20% | 20% | 20% |

| Cambodia | 10% | 45% | 45% | 20% | 20% | - |

| Indonesia | 20% | 40% | 75% | 10% | - | - |

| Laos PDR | 65% | 75% | 90% | 25% | 20% | 20% |

| Malaysia | 80% | 90% | 105% | 105% | 105% | - |

| Myanmar | 25% | 25% | 25% | 25% | 5% | 5% |

| Philippines | 15% | 50% | 100% | - | - | - |

| Singapore | 20% | 20% | 20% | 20% | 20% | 20% |

| Thailand | 30% | 40% | 50% | - | - | 3% |

| Vietnam | 45% | 50% | 60% | 30% | 15% | 15% |

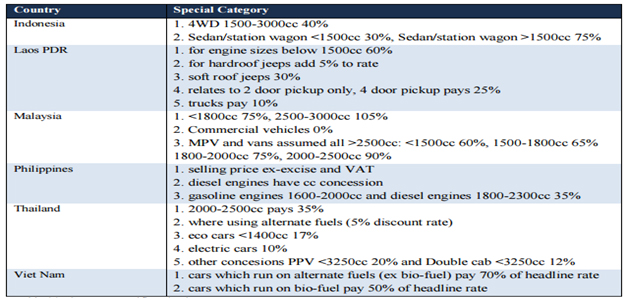

Categorization and Characterization of Motor Vehicles for the Purpose of Determining Tax Rates in Some ASEAN Countries

Sources : http://www.iticnet.org

Sources : http://www.iticnet.org