ASEAN excise tax

Excise tax detail devided by ASEAN countries

Comparison of Excise Tax in ASEAN Countries

At the present, Republic of the Union of Myanmar announces Myanmar Tax Law of the Union into force as law on April 2, 2015 by agreement of The Council of The Republic of the Union of Myanmar. This law has effected since April 2, 2015. The law amends Commercial Tax of goods and services from the previous law as per followings:

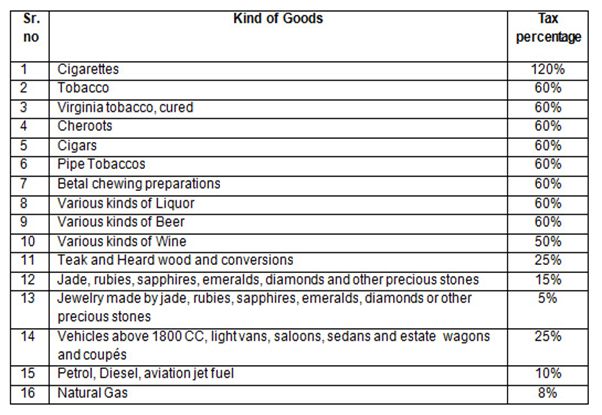

1) Special goods

The Commercial Tax (“CT”) rates for the import and production of 16 kinds of special goods will change under the New Tax of the Union 2015. For example, the CT-rate for the import and production of cigarettes will rise from 100% to 120% and the CT-rate on tobacco, liquor and beer will rise from 50% to 60%.

The CT-rate on jade, rubies, sapphires, emeralds, diamonds and other precious stones will decrease from 30% to 15%. The import and production for respective jewelry will also decrease from 15% to 5%.

When these special goods are imported, the tax will be charged on the landed costs. If they are produced in the country, the tax shall be charged on the sales proceeds.

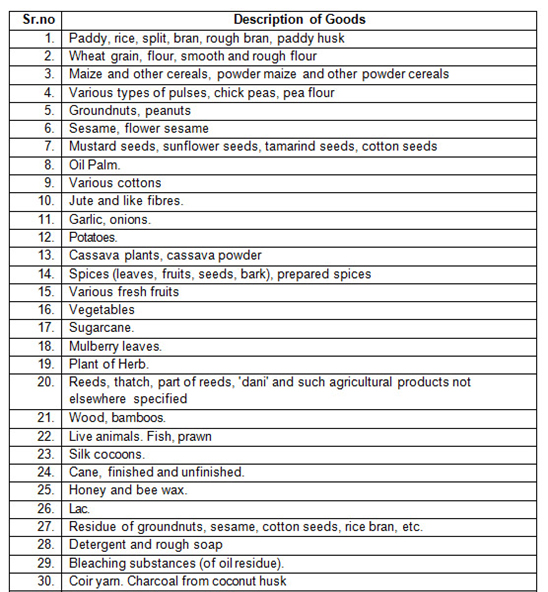

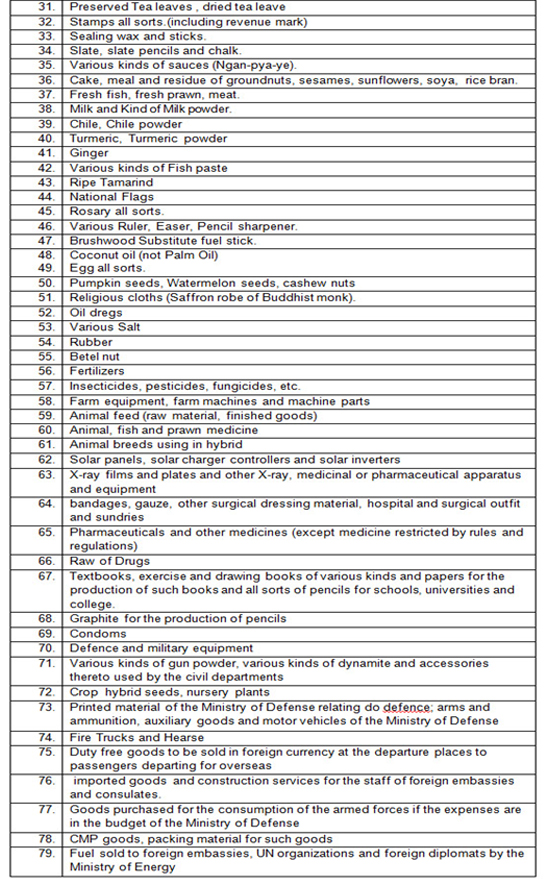

2) Commercial Tax exempted goods

Under The Tax Law of the Union 2014 84 kinds of goods were exempt from commercial tax. However, in the New Tax Law of the Union 2015 the number of goods exempt from commercial tax has been reduced to 79. For example, computers, telephone handsets, soap stocks (oil residue) and fresh and dried animal feed (farm products only) are not included under the new draft. On the other hand some additional goods have been included upon the exemption list, such as raw and dried tea leafs, fire trucks and hearse.

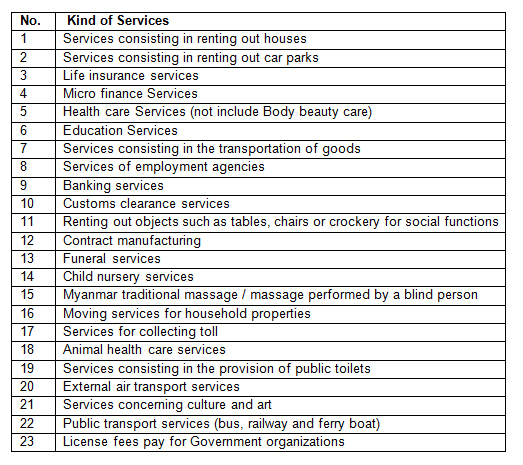

3) Commercial Tax exempted services

The Tax Law of the Union 2014 exempted 26 kinds of services from commercial tax, whereas in the Tax Law of the Union 2015 the number of services exempt from CT has been reduced to 23. Information and technology services, technology and administrative consultant services, container transportation services and license with slaughter services are no longer included in the Tax Law of the Union. License fees to be paid to government organizations have been amended to the exempt list.

All services not included in the list are subject to 5% Commercial Tax to be paid on the payment received for their services.

Additionally in the New Tax Law of the Union 2015 the construction and selling of buildings are subject to 3% Commercial Tax on sale proceeds.

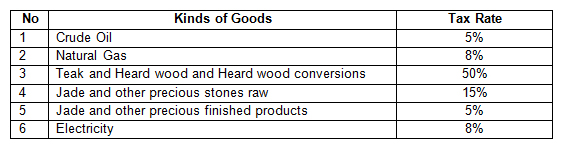

4) Commercial Tax on goods for export

The CT rate of exporting jade and other precious raw stones has been reduced from 30% to 15%, and jade and other precious finished products has been reduced from 10% to 5%.

Additionally Electricity has been added to the list in the Tax Law of the Union 2015 with a tax rate of 8% in case of export.

5) Threshold amounts of CT Exemption

The threshold for CT exemption of Production and sale of goods in Myanmar, as well as Services and Trading in Myanmar got increased under the Tax Law of the Union 2015 from 15,000,000 MMK to 20,000,000 MMK.

Excise Tax Collection Agencies

Agencies related to the collection of tax from the manufacturing of goods in the country and public consumption is The Internal Revenue Department

Taxpayers

In Republic of the Union of Myanmar, excise tax payers of domestic goods are producer or manufactory, and excise tax payers of import goods are importers.

Goods and Services Subject to Excise Tax

The government of Myanmar undertakes the collection of excise tax from imported goods and certain types of goods produced in the country as listed below:

- Oil and petroleum gas

- Automobiles: passenger cars, wagon-like passenger cars and wagon cars

- Hard woods, processed hard woods, teak woods and processed teak woods

- 4) Jade and valuable stones

- Liquors and alcoholic beverages: beers and wines

- Tobacco

- Electrical Appliances

- Railways, waterway, airway and road transport business

- Entertainment business

- Trading business consisting of purchase and sales of goods

- Hotel, Lodging

- Enterprise for sale of foods and drinks

- Travel and Tourism Services ( including Tour Guide business)

- Vehicles Cleaning and Oiling Industry, Mechanic & Body , Decoration Servicing

- Other Insurance except life insurance

- Hair Dresing Services and Body Fitness Services

- Press, Computer Word Processing and Computer Design Services (excluding photo copying)

- Brokerage Services

- Land, Building Designing and Decoration and Renovating

- Advertising Services, Photographing, developing Photo, Film or Video production ,Editing and Distribution Services

- Service Agency, Lawyer, Certified Public Accountant, Auditors

Tax Points

In case of excise tax collecting in Republic of the Union of Myanmar, tax payers have to pay tax for domestic goods at manufactory that produces the goods. On the other hand, tax payers have to pay tax for import goods as Customs formality.

Tax Base

In order to prescribe tax base for each excise tax calculation, tax base for domestic goods is calculated from selling price at manufacturing, and tax base for import goods is calculated from CIF

- Excise tax base (Domestic goods) = Selling price at manufacturing

- Excise tax base (Import Goods) = Import price (CIF) + Custom

Tax Rates

To prescribe tax rate of goods and services for each type in Union Tax Law 2015, goods and services are divided into types or characteristics as followings:

Type of Goods |

Tax Rate (%) |

Oil and petroleum gas |

|

| - Benzene fuel | 10 |

| - Diesel fuel | 10 |

| - Airplane fuel | 10 |

| - Natural gas | 8 |

Automobiles: passenger cars, wagon-like passenger cars and wagon cars |

25 |

Hard woods, processed hard woods, teak woods and processed teak woods |

50 |

Jades and valuable stones |

50 |

Liquors and alcoholic beverages: beers and wines |

50 |

Tobacco |

50 |

| - Cigarettes | 100 |