ASEAN excise tax

Excise tax detail devided by ASEAN countries

Comparison of Excise Tax in ASEAN Countries

Excise Tax Collection Agencies

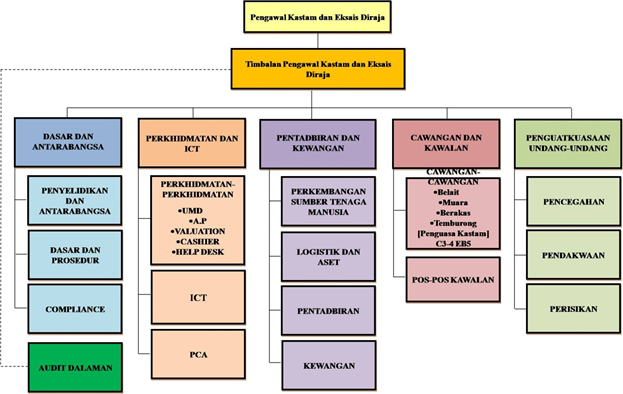

In Negara Brunei Darussalam, the Royal Customs and Excise Department, which has authority to collect excise tax, has organization chart as following:

The Royal Customs and Excise Department

Organizational Structure

(Source : http://www.mof.gov.bn/index.php/organisation-structure-royal-customs)

Taxpayers

Negara Brunei Darussalam prescribe that producers or manufactories have to pay excise tax for domestic goods and importers have to pay excise tax for import goods

Goods and Services Subject to Excise Tax

The Negara Brunei Darussalam government undertakes the collection of excise tax from imported goods and certain types of goods produced in the country which are listed below.

- Tobacco

- Alcohol beverages

- Motor vehicles

- Petroleum

Tax Base

For each type of tax collection, the excise tax base is calculated either per value or per unit as stipulated by law.

Tax Rates

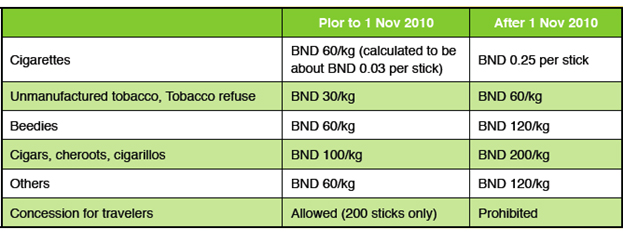

Tobacco

Since Brunei does not grow tobacco, all tobacco in Brunei is imported from other countries under the control of Ministry of Public Health. The ministry will issue a licenseto importers and retailers. The regulations for issuing the license are very strict. For example, do not sell tobacco in official places, on street, in gas stations, and 1 kilometers around a school. Since October, 2010, fee of license is 300 BND a year for retailers and 2,500 BND a year for importer. In November, 2010, import and purchase cigarette and tobacco excise tax was increased in order to discourage people to buy tobacco and give precedence to health and livelihood of residents, especially, to reduce risks of disease from using tobacco. In addition, a free tax concession for people who travel to Brunei was abolished and the tax will be collected as the table below:

(Source: http://tobaccotax.seatca.org/country/brunei)

Liquor

Liquor and alcoholic beverages excise tax in Brunei depends on % alcohol in the beverages. For example, excise tax for beverages made of grapes is BND 55/Dal for < 15% alcohol and BND 90/Dal for <15% alcohol. Excise tax for brandy or whisky that have >46% alcohol is BND 250/Dal.Automobile

Automobile excise tax rate in Brunei was increasedin order to reduce usage of automobiles in the country and to control or use of imported high fuel consumption automobiles. This is to make people realize effects of automobile to environment. Tax rate for engine displacement < 1700 cc was reduced from 20% to 15%. The tax is 20% for engine displacement 1700-2500 cc and 25-35% for engine displacement >2501 cc.(Source: http://www.bt.com.bn/home_news/2008/01/01/new_tax_plan_for_sin_products_cars)

Other Luxuries

Since April 1, 1995 excise tax for luxuries has been reduced. To illustrate, perfume tax was reduced from 30% to 5% and tax for furniture, air-conditioner, TV, and radio was reduced from 20% to 5%. In October 14, 1996, excise tax of textile and cloths was reduced to 10%(Source: http://www.mof.gov.bn/index.php/royal-custom-matters/amendment)