ASEAN excise tax

Excise tax detail devided by ASEAN countries

Comparison of Excise Tax in ASEAN Countries

Excise Tax Collection Agencies

The state agency that has the authority to carry out the collection of excise tax in Malaysia is the Royal Malaysian Customs that falls under the jurisdiction of the Ministry of Finance and derives authority from the Excise Act of 1976.

Taxpayers

- In the case of goods produced in the country, taxpayers refer to producers of the goods.

- In the case of imported goods, taxpayers refers to importers of the goods.

Goods and Services Subject to Excise Tax

The Malaysian government undertakes the collection of excise tax from imported goods and certain types of goods produced in the country as stipulated by the Minister of Finance in the Excise Duties Order 2012. Goods subject to excise tax are listed below:

- Alcoholic beverages

- Tobacco and tobacco products

- Motor vehicles

- Playing cards and mahjong

Tax Points

- In the case of goods produced in the country, excise tax burdens are incurred prior to transporting the goods from the factory or bonded warehouse of the producer, except in the case of automobiles where excise tax burdens are incurred when the automobile is registered with the Road Transport Department.

- In the case of imported goods, excise tax burdens are incurred by taxpayers at the entry point.

Tax Base

- In the case of goods produced in the country, the excise tax base is calculated per unit as stipulated by the Minister in the announcement issued by the Ministry of Finance and ad valorem (i.e. factory price)

- In the case of imported goods, the excise tax base is calculated per unit as stipulated by the Minister in the announcement issued by the Ministry of Finance and ad valorem(i.e. CIF + Customs Duties)

Tax Rates

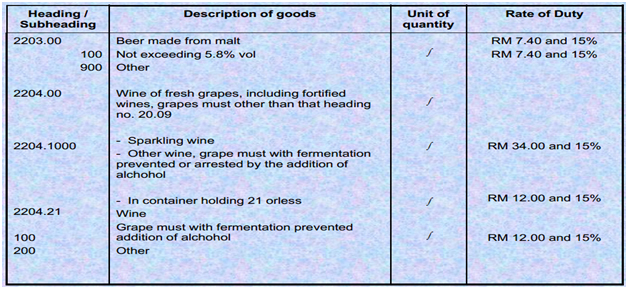

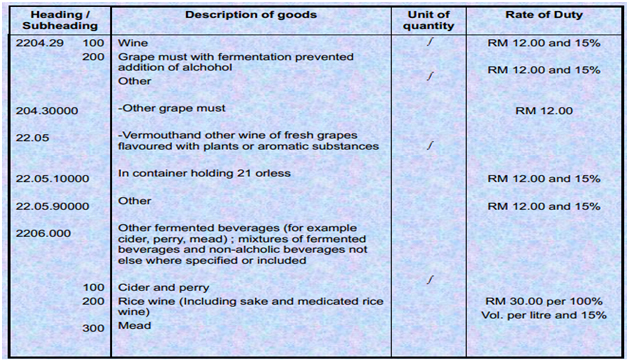

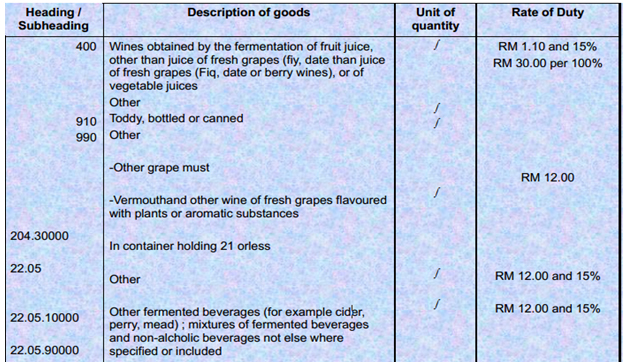

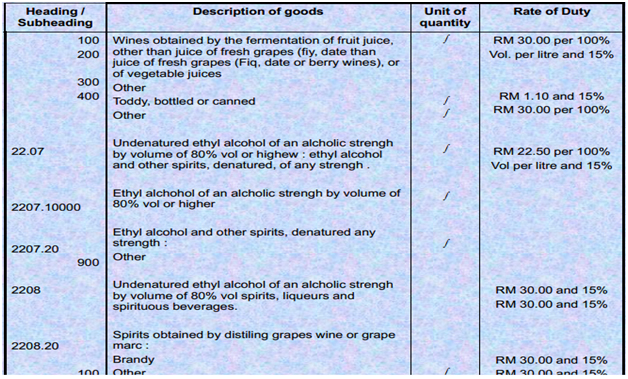

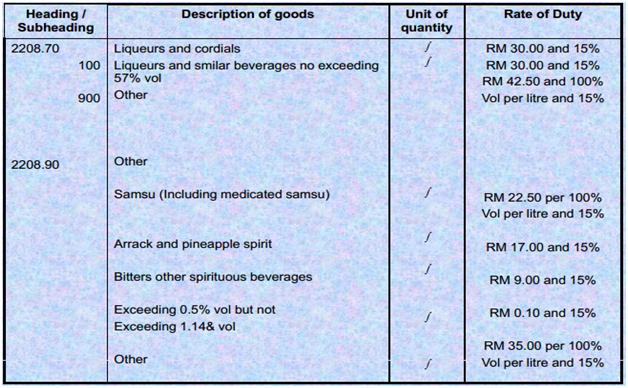

- Alcoholic Beverages

- Fermented Liquors

- Beer: Excise tax rate at 7.4% per liter or 15% ad valorem

- Wine: Excise tax rate at t 12% per liter or 15% ad valorem

- Sparkling: Excise tax rate at 34% per liter or 15% ad valorem

- Others: Excise tax rate at 1.1-4% per literor 22.5-33.5% per liter of pure alcohol or 15% ad valorem - Distilled Liquors

- 80 degrees or more: Excise tax rate at 22.5% per liter or 15% ad valorem

- Fermented Liquors

- Tobacco and Tobacco Products: classified into cigar, cheroots, cigarillos and cigarettes, and other products

- Cigars, cheroots, cigarillos and cigarettes: Excise tax rate at 7.5-220% per kilogram or 5-20% ad valorem or 0.22% per roll or 20% ad valorem, as the case may be

- Other products: Excise tax rate at 15-27% per kilogram or 5% ad valorem

- Motor Vehicles: classified into automobiles and motorbikes

- Automobiles: Excise tax rate at 10-105% ad valorem

- Motorbikes: Excise tax rate at 10-30% ad valorem

- Cards and Mahjong

- Cards: Excise tax rate at 10% ad valorem

- Mahjong: Excise tax rate at 5-10% ad valorem