ASEAN excise tax

Excise tax detail devided by ASEAN countries

Comparison of Excise Tax in ASEAN Countries

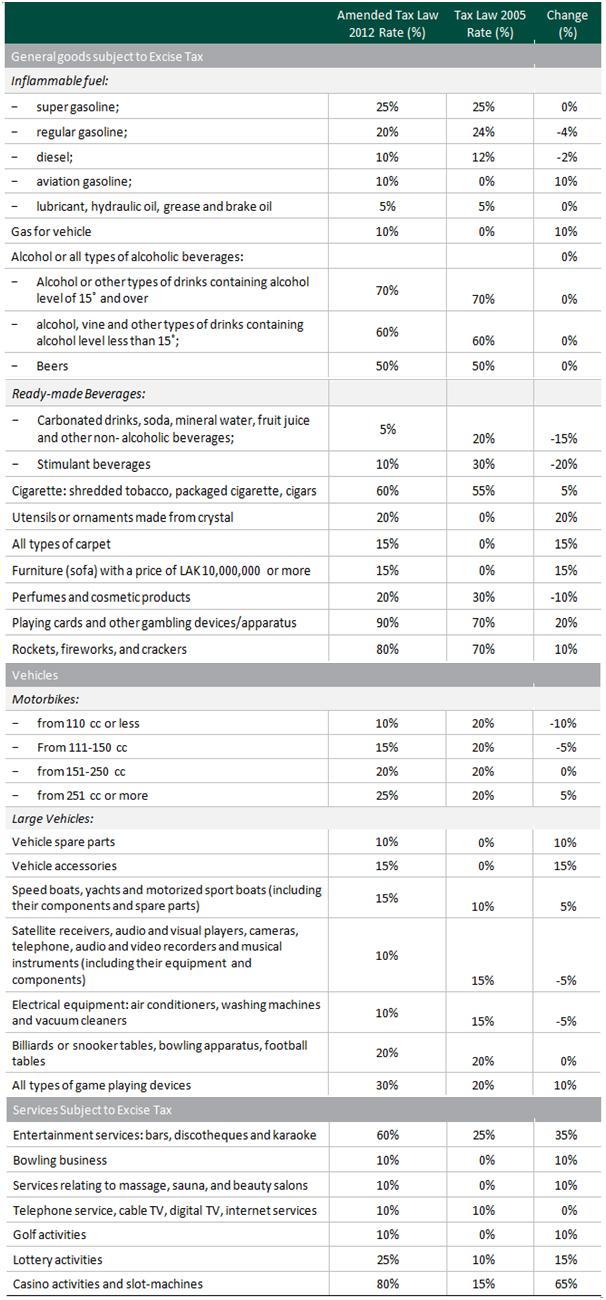

Excise Tax is levied on consumers of certain imported goods, domestic produced goods and services within the territory of Lao PDR through business operators who charge and pay to the state budget. Excise tax is collected on certain types of goods, including fuel (5 percent to 25 percent), alcohol (50 percent to 70 percent), carbonated drinks and invigorating drinks (5 percent to 10 percent), tobacco products (60 percent) and cosmetics (20 percent). Imports of equipment, means of production, spare parts, and other materials used in the operation of foreign investors' projects or in their productive enterprises are taxed at a uniform flat rate of one percent of the imported value. Raw materials and intermediate components, imported for the purpose of processing and then exported, are exempt from such import duties with approval from relevant ministries.

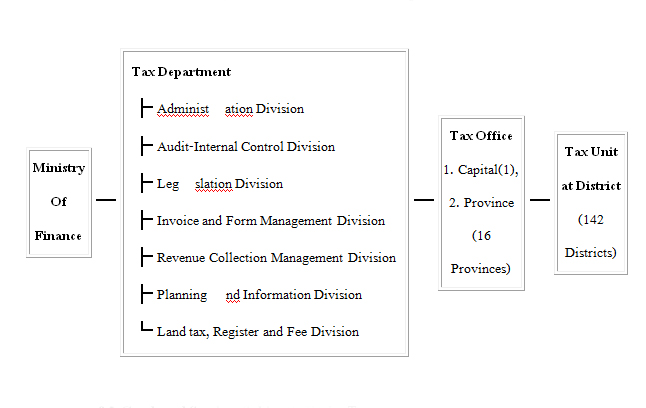

Excise Tax Collection Agencies

Department, Ministry of Finance

The Organization Structure of Tax Department

Taxpayers

- In the case of goods produced within the country: producers or industrial operators

- In the case of imported goods: importers

- In the case of service businesses: service operators

Goods and Services Subject to Excise Tax

- Fuel

- Compressed Natural Gas for vehicles

- Liqueur, beer or alcoholic drinks

- Aerated drinks including soft drinks, soda, energy drinks, mineral water

- Fruit juices and similar drinks

- Cigarettes including tobacco, cigarettes in packet, cigars

- Crystal items or crystal adornments

- All kinds of carpets

- Furniture sets (sofa) with the value from 10,000,000 kip and over

- Perfume, cosmetics

- Playing cards and gambling materials

- Traditional rockets, fireworks, crackers

- Vehicles including motorcycles and cars

- Vehicle spare parts and decoration items

- Speed boats, yachts and sport motor boats including their spare parts and accessories

- Satellite television signal receivers, audio-video players, cameras, telephones, audio-video recorders, musical instruments including their components and accessories

- Air-conditioners, washing machines, vacuum cleaners

- Billiard tables, snooker tables, bowling equipment, football game tables

- All kinds of game-playing machines

- Entet1ainment services: night clubs, discotheques, karaoke

- Bowling services

- Massages, sauna, beauty services

- Consumption of mobile phone, cable television, digital television and internet services

- Golfing services

- Lottery services

- Casino services and poker machines

Tax Points

Decree of the President of the Lao People's Democratic Republic On the Promulgation of the Tax Law section 23 prescribe that importers, producers, and service providers are responsible for paying excise tax as followings:

- For domestic goods, tax payers have to pay excise tax at excise department in the area

- For general import goods, tax payers have to pay excise tax at custom house

- For services providers, tax payers have to submit tax submission to local tax officer in the area that the business tale place by 15th of next month

- For automobile, the law prescribe that buyers or users of import cars or producer of domestic cars have to pay excise tax at department that the law prescribes.

Tax Base

- Imported Goods

Excise Tax = (CIF + Customs Duties) × Excise Tax Rate

- Goods Produced in the Country

Excise Tax = (Price at Factory – VAT) × Excise Tax Rate

- Services

Excise Tax = (Service Price – VAT) × Excise Tax Rate

- Automobiles Imported into or Assembled in the Country

Excise Tax = Selling Price × Excise Tax Rate

Tax Rates

Currently, Lao People’s Democratic Republic prescribes about excise tax rate of goods and services in Decree of the President of the Lao People's Democratic Republic On the Promulgation of the Tax Law (Amended version) section 20. There are changes of excise tax of goods and services as followings: